Over the last 10 years, the floodgates of capital have opened dramatically in the real estate market, and continue to remain open, providing borrowers and investors with more options and opportunities.

How We Got Here

In the immediate years following the Great Recession of 2008, capital was severely limited. Institutional lenders had practically frozen new lending activity, and the investments of most legacy private sources of capital had crashed as a result of the rapid loss of value in real estate assets, poor credit decisions and highly-leveraged investments.

New private lenders that entered in the market during this time lent on assets whose values had readjusted to the existing market conditions, and as a result, increased their equity positions with a lower cost basis. Meanwhile, federal regulation, spurred by the 2010 Dodd-Frank law, weighed heavily on banks and other traditional lenders, further limiting the availability of capital

Then market started to adjust. It didn’t take long for conditions and subsequent actions resulting from the recession—historically low interest rates and low construction costs, combined with new monetary and fiscal initiatives—to stimulate the economy. Even before the institutional world took notice, and as they reeled from the recession, private investors had started buying and developing again, especially in emerging submarkets like Brooklyn on the East Coast, and in the West, the Arts District of downtown Los Angeles.

Institutional capital soon followed, as did private lending. The lower cost of capital in the market allowed newly-formed debt funds backed by private equity, hedge funds and life insurance companies, to deploy capital on commercial and residential lending opportunities, while arbitraging the increasing spreads. The combination of more available capital, low borrowing costs, depressed valuations and attractive pricing on raw materials, started heating up the real estate market again.

Fast Forward to Today

The tax cut passed earlier this year also has been a boon for financial institutions. The larger banks and institutions are only now selectively returning to construction lending, due to the HVCRE rules that impose higher loss reserves and increased direct equity contributions from sponsors of development projects. Consequently, banks and institutions are providing less financing of the total construction budget for these projects, and developers have had no choice but to seek private money to bridge the gap.

Interestingly, many institutional owners and developers have created debt funds to invest in subordinated tranches of construction loan debt to cover the shortfall on bank construction loans. While it is challenging to find development sites that make sense at today’s cost of entry, banks are providing mezzanine debt to 75% or 80% of the capital stack—a viable basis should they have to step in and take over the asset.

Debt Fund Market is Too Hot

The debt fund market is as hot and active as ever.

Debt funds have had no trouble raising capital from both domestic and foreign investors, as they are finding cheaper sources of capital which often can be very competitive, especially for financing transitional properties. The bridge loan space, in particular, is very competitive, with debt funds competing head-to-head with commercial banks. Quality sponsors in this space are seeing multiple bids on financing requests, with a race to the pricing bottom. Many insiders with whom we spoke also are starting to see pressure on covenants, as more lenders try to find ways to win business.

As debt funds overheat in this highly competitive market and are forced to deploy capital to avoid depressing yields, investors are taking on more risk by capitalizing lesser-quality collateral in blind pools of highly-leveraged loans that are cross-collateralized by bank debt with onerous covenants. This hapless by-product of an overheated capital market environment is resulting in a growing deterioration of investors’ equity positions that in previous, cooler economic years, helped protect their downside risk.

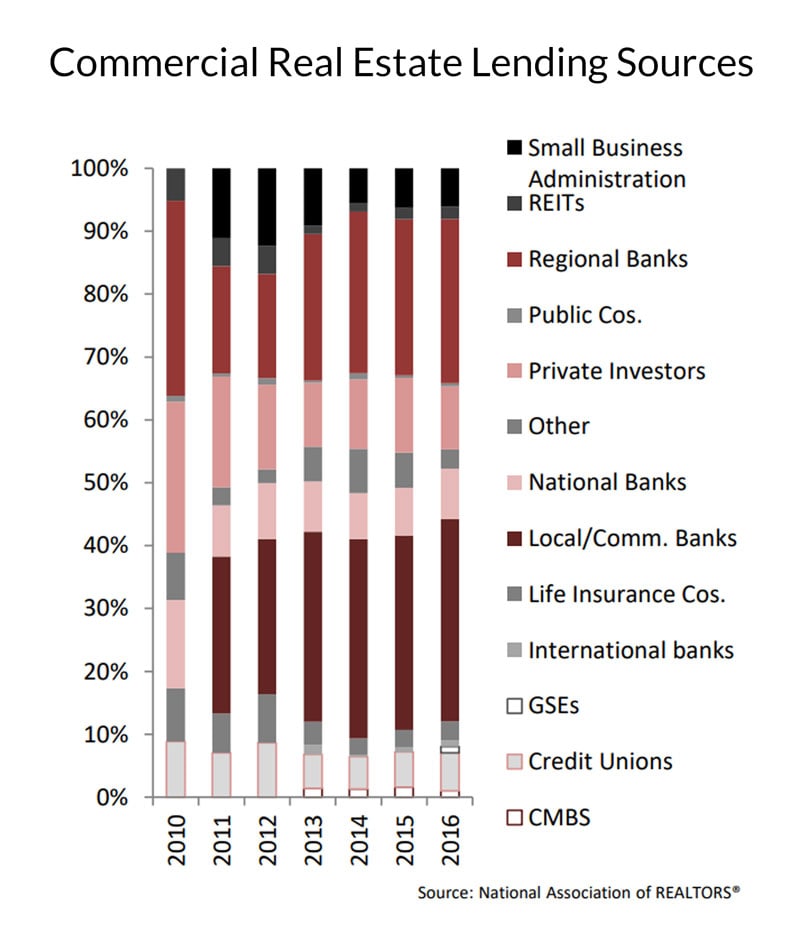

Private lending opportunities have increased due to the changes in institutional lending. As the number of loans issued by private lenders increases, there was a decline in loans issued by traditional banks. During 2011, there were three banks that issued 50% of the loans. Currently, private lenders are the ones issuing the majority of loans.

A Better Dwelling report recently revealed that private lenders originated more than $2 billion nationally last year and currently have about 7.87% of the national mortgage market. Another source said that private capital has grown steadily over the past few years and accounted for 51% of all real estate purchases in 2017

So, Is Private Lending the New Normal?

There are several salient, key competitive advantages to consider when looking at private lending.

- Private lenders are nimble, much more so than larger institutions, and can move quickly to fund…in days, instead of weeks or even months, especially through new digital platforms that streamline the process.

- Private lenders have the ability to fill voids and meet needs that are caused by short time horizons, impaired credit, limited liquidity, and transitional property scenarios or business plans that are more complex than regulated lenders can undertake.

- And, given the monumental shift in the availability of capital, the private lending industry is looking more like the institutional world in terms of pricing. How long this will last in view of the current economic outlook over the next few years is anyone’s guess.

Where Do We Come In?

Investors who seek private debt funds can benefit from using the services provided by Wheeler Capital Partners. We can assist investors or borrowers with the development of strategic financing plans for banks, insurance companies, CMBS placement and private lenders or debt funds. We as intermediaries work for you work in an independent manner presenting your project to multiple funding sources which will provide multiple solutions to achieve your goals.

The team at Wheeler Capital Partners has considerable experience in the lending industry to assist clients with achieving the funding they desire. With over three decades of banking experience and an awareness of the requirements of various lenders to expedite the process for clients, a private lender could be the right choice.