CMBS Declined in 2018 and Expected to Decline 5 to 10% in 2019

Understanding the Current State of Commercial Mortgage-Backed Securities

At one time, commercial mortgage-backed securities were very popular. In recent months, however, lenders offering this option are having a hard time retaining market share in this area. The market is just so competitive right now, and it also doesn’t help that conduit lending is suffering as a whole.

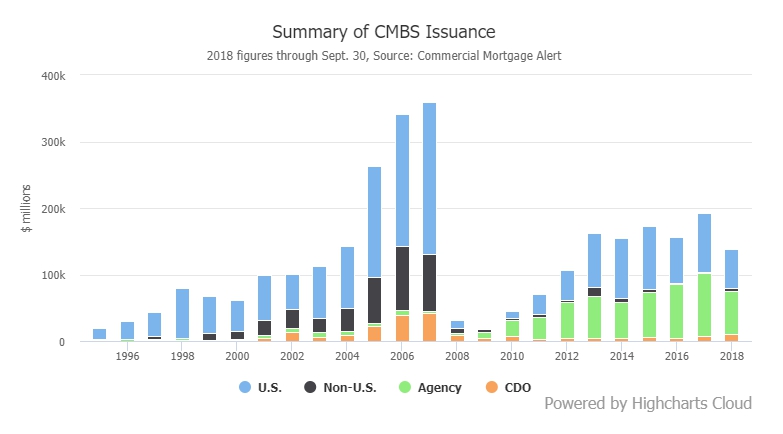

Trepp, an analytical securities and investment management company, is forecasting that CMBS issuance will decline in 2019 by about 5 to 10 percent. This declining trajectory is following the same path in 2018 when CMBS issuance totaled $77 billion in the United States as compared to the $87.8 billion in the same time frame of 2017.

What is Causing this Rapid Decline?

As unfortunate as these facts may be for lenders, the truth is that CMBS lending is down. The important thing is to determine why. After all, that is the only thing that’s going to bring about any kind of change.

One cause industry experts propose is fewer maturities being readily available. In the future, the volume of maturities is likely to increase. Hopefully, that will help the state of CMBS, but as of now, the market is really suffering.

Increasing competition is also a problem affecting the CMBS scene. While CMBS was once the most popular type of higher leverage loans, capital is more commonly moving into higher yielding options these days. These include options like private equity debt funds or mezzanine loans. Not only are such loans typically higher-yielding, but they are also more flexible, which makes them appealing to more and more diverse investors.

Due to that competitive landscape, CMBS lost traction in 2018. Shorter duration loans were more interesting to borrowers last year, perhaps because of late stage business plans. Per Joe DeRoy, a senior vice president and CMBS program leader for KeyBank Real Estate Capital says, “We saw a lot of five to seven-year requests in 2018, more than we had seen in years prior.” Borrowers were able to obtain more leverage through the CLO market than the CMBS market by going with the three-year/plus one/plus one route on non-recourse floating rate debt.

Reference: https://www.nreionline.com/cmbs/cmbs-issuance-might-decline-5-10-percent-2019

Credit Quality is Deteriorating

Moody’s Investors Service is expecting that debt service coverage ratios of loans that are newly originated will continue to decline in 2019 coupled with rising interest rates. They also expect CMBS exposures to interest-only loans, single-tenant loans, and loans with subordinate debt will remain high. Because of the moderately rising interest rate environment and refi valuation, interest-only loans are viewed as riskier. According to Moody’s research, more than half of the 2.0 CMBS loans are interest-only which reminds everyone of 2007 levels.

Can Anything Be Done to Improve the CMBS Scene?

In 2019, the fate of CMBS will be linked to performance in other markets such as residential, high yield, and corporate credit markets. While things are not looking great for CMBS lenders at the current moment, there are things that could help change that in the future.

Already, many in the CMBS market are making the smart move of sourcing low leverage loans to help balance out the losses they are experiencing and to make this type of lending more accessible for more people.

Offering interest-only loans is an other strategy that is proving very helpful for CMBS lenders. Furthermore, CMBS lenders that differentiate themselves by offering new products or services also stand a good chance of “staying afloat” and riding out this tough time for CMBS loans.

There are key issues to watch for in 2019 such as major corporations like GE being downgraded, large ETF outflows, and how the leveraged loan market will function. These factors may cause CMBS spreads to widen and at some point, the other asset classes become very competitive with CMBS, which usually prompts investors to recalibrate.

The important thing to remember in the financial sector is that fluctuations are common and always will be. The key is to predict these fluctuations as well as possible and then to work hard to combat and protect against those that may have a temporarily negative effect.